Subscribe to Blog via Email

Good Stats Bad Stats

Search Text

April 2025 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 -

Recent Posts

Good Stats Bad Stats

goodstatsbadstats.com

Fast food, wages, and government subsidies

Last week the report titled: Fast Food, Poverty Wages – The Public cost of low-wage Jobs in the fast-food industry by Sylvia Allegretto, Marc Doussard, Dave Graham-Squire, Ken Jacobs, Dan Thompson and Jeremy Thompson was released. The report comes out of the University of Illinois and the University of California Berkley Labor Center. The report provided estimates of how much government money is given in one form or another to those working in the fast food industry. It attempts to make the case that workers there are underpaid and living in poverty or near poverty.

An immediate red flag on the analysis is that the study was funded by Fast Food Forward. This is a coalition fighting for higher wages for fast food workers in New York. The authors brought together a number of data sources such as the Current Population Survey Income Supplement data and data from the American Community Survey, and other sources to develop their models. But the real issue in the discussions was not so much their analysis but the concept they have put forth.

What is that concept? In a real way the authors are arguing that the government is subsidizing the fast food industry. How can that be?

Step back and look at the big picture. The fast food industry pays very low wages. They are so low in fact the many workers rely on government benefits through the various public assistance programs. They also supplement their incomes by use of the “Earned Income Credit” when they file their tax returns. I can argue, convincingly that these programs as designed to help those in poverty. That would be true. But I can also make a valid case that if the fast food industry paid better wages these same people would be collecting less in the way of public assistance and may no longer be eligible for the earned income credit. The fast food industry then can pay lower wages because those government programs exist. So the issues is are we helping to poor with those payments or are we also subsidizing the fast food industry.

It may be hard for some to buy into the argument that the government payments are a subsidy of the fast food industry. But it the same line of reasoning that is made when claims are made that government tax breaks for college education allow universities to raise their tuition. This is basic economics of supply and demand. In the case of college tuition because you have more money to spend the university can charge more. In the case of the fast food industry because the workers’ wages are subsidized by the government via public assistance the industry can pay lower wages.

The response by the fast food industry bought into this logic when Scott DeFife, Executive Vice President, Policy & Government Affairs, National Restaurant Association said

“These misleading efforts use a very narrow lens and selective data to attack the industry for their own purposes and fail to recognize that the majority of lower-wage employees works part-time to supplement a family income. Moreover, 40 percent of line staff workers in restaurants, the primary focus of the reports, are students.

“The inclusion of the Earned Income Tax Credit shows just how misleading these efforts are, as it is a tax credit specifically designed for working families, not public assistance, and is used to inflate their numbers.”

What he has unwittingly done with this argument is to accept that certain public assistant programs cost were legitimately included in the costs of the low wages as government expenses. He has gotten himself into arguing that certain cost, the earned income credit, should not be included. By using the phrase “inflate their number” he has conceded the legitimacy of the argument that at least some of the costs are in fact a subsidy to the fast food industry.

This is a typical line of argument. Proponents of wage increases want to make the government cost numbers to be as large as possible. Opponents want those cost to be as low as possible. So they argue over what cost should be included. Those who want assistance for the poor want poverty defined as broadly as possible. In the last election the Republicans used a broad definition of unemployment rather than the official numbers put forth by the Bureau of Labor Statistics. I don’t really see how the National Restaurant Association can make a convincing argument for the exclusion of the earned income credit in the authors’ analysis.

Also attributined to the fast food industry was:

Representatives from the restaurant industry have said in the past that fast food eateries operate on thin profit margins. They’ve argued that any wage boost could put franchisees — which run most fast food restaurants — out of business, or hamper their ability to hire.

This is not really a good argument. I have never heard them saying if the cost of bread, meat, potatoes, or electricity goes up they will suffer the same consequences. Yet this would be an equivalent claims.

McDonald’s in a reply to the report said:

“As with most small businesses, wages are based on local wage laws and are competitive to similar jobs in that market”

But this really only says we pay the minimum wage or better (local wage laws) and if everyone else pays a poverty wage it is ok for us to do so as well. And this is the bind that the fast food industry is in. No matter what the minimum wage is the wages paid will then due to completion to converge to that point. Other wise the fast food chain that paid a higher wage would find itself losing to the competition because of their own higher costs. But in some ways this is a false argument as the industry seems to consistently oppose any increases in the minimum wage.

Sorry that I did not put any numbers into this post. The main point, teaching moment if you will, is that in statistical analysis logic, assumptions, and positioning on the issue area every bit as important to the arguments being made as are the numbers themselves. In this debate both sides are trying to define the “ground truth” and then argue from that position that they are right. Unless we, the readers, recognize what is happening here it is very easy to listen to just one side of the argument and buy into the conclusions being made by the advocates for that side.

Interview by Kaiser Fung of Numbersense

Kaiser Fung has posed an interview with me over at his site: Numbersense. It is a two part interview – Part 1, Part 1. Read at your leisure.

Kaiser is the author of Numbers Rule Your World and Numbersense: How to Use Big Data to Your Advantage.

Posted in Uncategorized

The government shutdown, the Republicans, and the polls

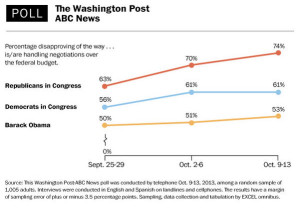

Most media sources are saying that the Republicans are taking a real beating from the public on the current government shutdown. The Washington Post story utilized the graphic at the right to illustrate the situation. They like many in the media have focused on the disapproval number – telling us how many disagree with either party’s handling of the situation.

Most media sources are saying that the Republicans are taking a real beating from the public on the current government shutdown. The Washington Post story utilized the graphic at the right to illustrate the situation. They like many in the media have focused on the disapproval number – telling us how many disagree with either party’s handling of the situation.

But the real story may well be what is happening when we look at the approval numbers. Looking at the graphic the disapproval rates for the Republicans have increased from 63 to 74 percent. That is an increase of 11 percentage points or a 17 percent increase from where they stared two weeks ago. Take a moment to look at it from the other side. What is happening to their support? Each week the Washington Post has repeated the same questions in their survey the weekly results for this question are posted here, here, and here. Looking that he approval number they have gone from an initial approval level of 26 percent to 24 percent last week, and now are down to 21 percent this week. They have lost 5 percentage points on their base – that amount to a loss of 19 percent. At the same time the Democrats have gone from an approval level of 34% at the start of the shutdown to 33% this week. That is a loss of only 3 percent of their base.

The choice of perspective makes all the difference. A disapproval rate of 61 percent for the Democrats looks bad. A disapproval rate of 74 percent for the Republicans looks worst. But when I see that the Republicans have lost 19 percent of their supporters while the Democrats have lost only 3 percent of their supporters it tells a very different story.

What also should be disconcerting for the Republicans, and that does not show up in any of the analysis is what has happened to the “no opinion” group. The actual survey questions allowed not only approval disapproval but also a no opinion answer. The first week the “no opinion” group amounted to about 10 percent of the respondents. In weeks two and three that group declined to approximately 5 percent of the respondents. Apparently the Republicans could not gather any support from those who decide in subsequent weeks that they did now have an opinion. The Democrats did not do much better, but they were not losings support from their base at the same time.

Posted in Telling the Full Story, The Media