Subscribe to Blog via Email

Good Stats Bad Stats

Search Text

June 2025 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 -

Recent Posts

goodstatsbadstats.com

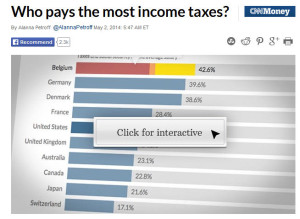

Who pays the most taxes? A worthless graphic

I spotted this graphic over at CNN tonight. But they don’t get the real credit as it came from the Organisation for Economic Co-operation and Development. The full CNN article is here, and the interactive graphic is here.

I spotted this graphic over at CNN tonight. But they don’t get the real credit as it came from the Organisation for Economic Co-operation and Development. The full CNN article is here, and the interactive graphic is here.

It is hard to imagine how to construct a less informative graphic to compare tax rates around the globe. How many problems can I name?

The comparisons are base on a single childless worker making what is described as the average salary in their country. How can anyone think that represents the complexity of the tax code anywhere? Tax structures vary by country. Not all are equally progressive, or regressive – depending on your view point. And is a single person typical in any sense? Does the average salary say anything about the tax rates of most people?

Then there is the question of what the taxes actually pay for. In the United States there has been a lot in the news about the advent of Obama care. But in truth much of the costs of insurance is born by the individual in the United State. While in other countries the state pays those costs through the taxes they collect. How do I compare taxes that don’t even pay for the same thing?

Next there is the issue of local taxes. The CNN piece tells me that in the United States they used the local taxes for Detroit, MI. What? They claimed that was something lower than average. But what tax are they counting? Are property taxes included? I don’t know. For the other countries CNN tells me nothing about how the local taxes are computed. Do they use taxes in Berlin for the German tax rates? Who knows?

In the United State they use 7.7% for the Social Security Tax. What about the employer contribution to that tax? Shouldn’t that be counted as well?

Come on CNN, come on the Organization for Economic Co-operation and Development, people deserve better reporting than this represents.