Subscribe to Blog via Email

Good Stats Bad Stats

Search Text

March 2026 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 -

Recent Posts

goodstatsbadstats.com

Explaining Reasons for Income Inequality

Last week the Census Bureau released the report Household Income Inequality Within U.S. Counties: 2006–2010 providing data on income inequality for all counties in the United States. Their Chosen measure for this analysis is the Gini Index. The calculations were based on five years of American Community Survey household data.

On the same day the DC Fiscal Policy Institute released the report Big Gap: Income Inequality in the District Remains One of the Highest in the Nation. They looked at income inequality in 50 of the largest cities and found that the District of Columbia(DC) ranked third using their measure. Instead of utilizing the Gini index they choose to use the ratio of mean income of the 20% highest income earners to the income for the lowest 20% of income earners. They used just the 2010 American Community Survey household data.

The DC Fiscal Policy Institute report focuses mainly on the situation in the District of Columbia and examines why the income gap is as large as it is in the District. It goes on to make suggestions for improving the situation. It is that part of the discussion that I want to focus on in this posting. I also want to discuss one aspect of the coverage of the report by the Washington Post. I will likely return in a subsequent post to focus on issues important to comparisons of the level of income inequality across political jurisdictions.

The report focus on educational levels as being a main driver of income inequality saying:

This wide gap in income points to a city with two economies. Residents with a college degree largely are thriving in DC’s government- and information-driven economy. Meanwhile, those who lack higher education have far fewer opportunities for economic success.”

The Washington Post in their article on the report made some significant changes to this quote saying:

The institute’s report, to be issued Thursday, said the dichotomy was the result of two vastly different economies in the District. One is populated by college graduates thriving in well-paying information and government jobs. The other is for people lacking higher education, scrambling for even low-paying work.

Both quotes focus on education as driver in income inequality. The difference here is that the DC Fiscal Policy Institute focuses on the type of economy in DC while the Washington Post focuses on two specific types of employers – information technology and government. The Washington Post should have gone beyond the data in the report to better understand the situation.

Just looking at Federal pay statistics from OMB of salaries for those in the Senior Executive Service(SES), with bonuses included, range between $152,000 and $183,000. While those salary levels would put them in the top 20% of income earners in DC it is not high enough to drive the main income of those in the top 20% cell to the mean income level of $250,000 cited in the DC Fiscal Policy Institute report. There would have to be a second person in the same household making a good income to bring the household income for those in the SEC up to the $250,000 figure. In addition OPM reports that of the almost 8,000 members of the SES only about 75% of them live in the DC metropolitan area. Likely far fewer actually live in the District of Columbia itself. Further the BLS puts the Civilian Labor Force for DC at about 300,000. So those living in DC and making the higher salaries represent only very small segment of population.

The DC Fiscal Policy Institute report goes on to focus on other reasons for the level of income inequality in DC.They claim that the DC metropolitan area has “one of the highest central city and suburban poverty disparities among large cities in the nation.” They point to stagnate salary levels for those in DC with only a High School diploma. Yet the data paint a bit of a different story. If one wants to understand why DC has a higher level of income inequality they need to look at the reason why the high income households have such large incomes. For in the report they say:

The poorest DC households by contrast — those in the bottom fifth by income — had an

average income of $9,100. This is close to the average among the largest U.S. cities.

The low end of the income scale DC is very much in the mainstream of the top 50 cites in the country. Thus the larger income inequality in DC relative to other cities lies in the level of income earned by those in the top 20% of the income distribution. Yet the report suggests:

Addressing income inequality — lifting the incomes of those at the bottom — requires adequate

funding for programs that support the city’s workforce and affordable housing supply.

These suggestions however only address those at the low end of the distribution and thus would be appropriate in any of the 50 cites. Implemented they may well reduce the spread in the level of income inequality. However they do nothing to address why the incomes in DC in the upper 20% of households as higher than those in other cities. I do fail to see how providing “affordable housing” does anything to reduce income inequality. In fact providing “affordable housing” could well have the reverse effect as with more available it would make it easier for those with low incomes to move into the city or remain in the city and thus exacerbate the measures of income inequality.

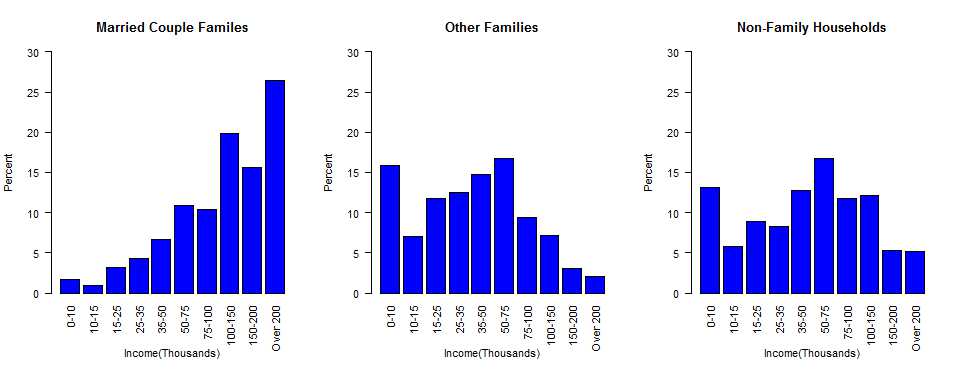

Missing from the discussion is the impact of family structure on the level of income. Data from the American Community Survey on income levels is readily available from the Census Bureau on American Factfinder. The graph below shows the income distribution with data from the 2010 American Community Survey for the District of Columbia for three types of households.

With 26% of the married couple households making over $200,000 and only 5.2% of non-family households and 2.1% of non-married households in that category it is clear that it is the married couple households that is driving the upper end of the income distribution. The opposite effect happens at the low end of the income distribution. This then must be a big component of the reason for the level of income inequality in the District of Columbia. Having two earners in a household makes a significant difference when both can earn an income.

Similar graphs could be produced using education instead of marital status and would likely show that education, as claimed in the DC Fiscal Policy Institute report, is also an important component of income inequality. Changing either of these demographic features of the population of the District of Columbia is not going to be done quickly. But without change on these dimensions the level of income inequality in the district is not likely to change very soon.

Posted in Methodolgy Issues

[…] week I posted a piece about the release by the Census Bureau of the report Household Income Inequality Within U.S. […]